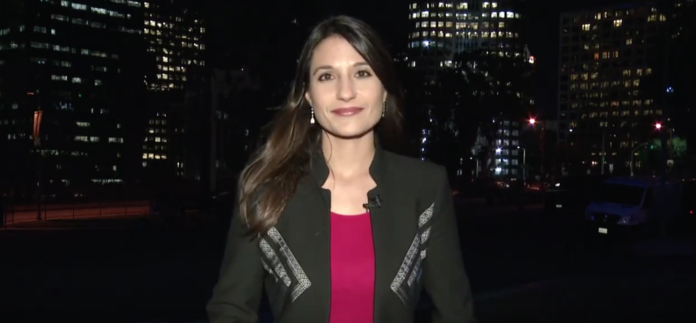

Aitana Vargas’s exposé on Hadari Oshri nominated for journalism award

Oshri tried to stop the release of Vargas's series exposing her alleged participation in a $370M PPE scheme

In June 2021, Investor News reporter Aitana...

SEC Announces Older Investor Roundtable Virtual Event on April 28

Washington D.C. — The Securities and Exchange Commission will hold a virtual event on April 28 along with the North American Securities Administrators Association...

Allianz Global Investors Agrees to Pay More Than $1 Billion to Resolve SEC Charges

SEC Charges Allianz Global Investors and Three Former Senior Portfolio Managers with Multibillion Dollar Securities Fraud

Washington D.C. — The Securities and Exchange Commission (SEC)...

SEC Raises Threshold for Reg A+ Offerings to $75 Million

SEC Raises Threshold for Reg A+ Offerings to $75 Million

On November 2, the Securities and Exchange Commission (SEC) approved amendments, originally proposed in the SEC’s June...

SEC Extends Comment Period for Proposed Rules on Climate-Related Disclosures, Reopens Comment Periods for Proposed Rules Regarding Private Fund Advisers and Regulation ATS

Washington D.C. — The Securities and Exchange Commission this week announced that it has extended the public comment period on the proposed rulemaking to...

SEC Adopts Rules to Require Electronic Filing for Investment Advisers and Institutional Investment Managers

Washington D.C. — The Securities and Exchange Commission has adopted amendments to require certain documents filed by investment advisers, institutional investment managers, and certain...

SEC Proposes Rule Changes to Prevent Misleading or Deceptive Fund Names

Washington D.C. — The Securities and Exchange Commission this week proposed amendments to enhance and modernize the Investment Company Act “Names Rule” to address...

SEC Obtains Emergency Relief to Halt Pre-IPO Stock Fraud Scheme by Unregistered Broker-Dealer

Defendants, including persons barred from the brokerage industry, allegedly sold shares they didn’t own, and pocketed more than $75 million

Washington D.C. — The Securities...

SEC Nearly Doubles Size of Enforcement’s Crypto Assets and Cyber Unit

Washington D.C., May 3, 2022 — The Securities and Exchange Commission today announced the allocation of 20 additional positions to the unit responsible for...

Check out SEC’s updated list of firms using inaccurate information to solicit investors

Washington D.C. — The Securities and Exchange Commission today announced that it updated its list of unregistered entities that use misleading information to solicit...