An Oklahoma woman pleaded guilty in the Western District of New York for a scheme to defraud the Paycheck Protection Program (PPP) of over $43.8 million in COVID-19 relief loans guaranteed by the Small Business Administration (SBA) under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

According to court documents, Amanda J. Gloria, 45, of Altus, admitted that she conspired to submit at least 153 fraudulent PPP applications seeking a total of approximately $43.8 million on behalf of at least 111 entities between approximately May 2020 and June 2021. Gloria admitted that she falsified or aided and assisted with falsifying various information on these loan applications, including the number of employees, payroll expenses and documentation, and federal tax filings. Gloria then submitted or aided and assisted with the submission of the fraudulent PPP applications to financial institutions. In total, the recipient entities unlawfully obtained approximately $32.5 million in PPP funds. From those fraudulently obtained funds, Gloria personally received at least approximately $1.7 million.

Gloria also admitted that she conspired with Adam D. Arena to submit a fraudulent PPP loan application seeking approximately $954,000 for ADA Auto Group LLC, a previously inactive Florida-based business owned and controlled by Arena. After fraudulently obtaining the PPP loan, Gloria directed Arena to launder the proceeds, including by transferring nearly $25,000 to a bank account held in the name of WildWest Trucking LLC, an Oklahoma-based business owned and controlled by Gloria. Gloria also admitted that she submitted and fraudulently obtained a separate PPP loan for WildWest Trucking LLC for approximately $421,000. Arena pleaded guilty in November 2021 to one count of conspiracy to commit bank fraud and one count of engaging in a monetary transaction with criminally derived proceeds in a related case.

Gloria is scheduled to be sentenced on July 20 and faces up to 30 years in prison for conspiracy to commit bank fraud and up to 10 years in prison for money laundering. A federal district judge will determine any sentence after considering the U.S. Sentencing Guidelines and other statutory factors.

Assistant Attorney General Kenneth A. Polite, Jr. of the Justice Department’s Criminal Division; U.S. Attorney Trini E. Ross for the Western District of New York; Assistant Director Luis Quesada of the FBI’s Criminal Investigative Division; Special Agent in Charge Stephen Belongia of the FBI’s Buffalo Field Office; and Special Agent in Charge Thomas Fattorusso of IRS Criminal Investigation (IRS‑CI) made the announcement.

The FBI and IRS-CI are investigating the case.

Assistant Chief Cory E. Jacobs and Trial Attorney Jennifer Bilinkas of the Criminal Division’s Fraud Section and Assistant U.S. Attorney Laura A. Higgins for the Western District of New York are prosecuting the case.

The Fraud Section leads the Criminal Division’s prosecution of fraud schemes that exploit the PPP. Since the inception of the CARES Act, the Fraud Section has prosecuted over 150 defendants in more than 95 criminal cases and has seized over $75 million in cash proceeds derived from fraudulently obtained PPP funds, as well as numerous real estate properties and luxury items purchased with such proceeds. More information can be found at https://www.justice.gov/criminal-fraud/ppp-fraud.

On May 17, 2021, the Attorney General established the COVID-19 Fraud Enforcement Task Force to marshal the resources of the Department of Justice in partnership with agencies across government to enhance efforts to combat and prevent pandemic-related fraud. The Task Force bolsters efforts to investigate and prosecute the most culpable domestic and international criminal actors and assists agencies tasked with administering relief programs to prevent fraud by, among other methods, augmenting and incorporating existing coordination mechanisms, identifying resources and techniques to uncover fraudulent actors and their schemes, and sharing and harnessing information and insights gained from prior enforcement efforts. For more information on the department’s response to the pandemic, please visit https://www.justice.gov/coronavirus.

Anyone with information about allegations of attempted fraud involving COVID-19 can report it by calling the Department of Justice’s National Center for Disaster Fraud (NCDF) Hotline at 866‑720‑5721 or via the NCDF Web Complaint Form at https://www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form.

Press release distributed by the DOJ.

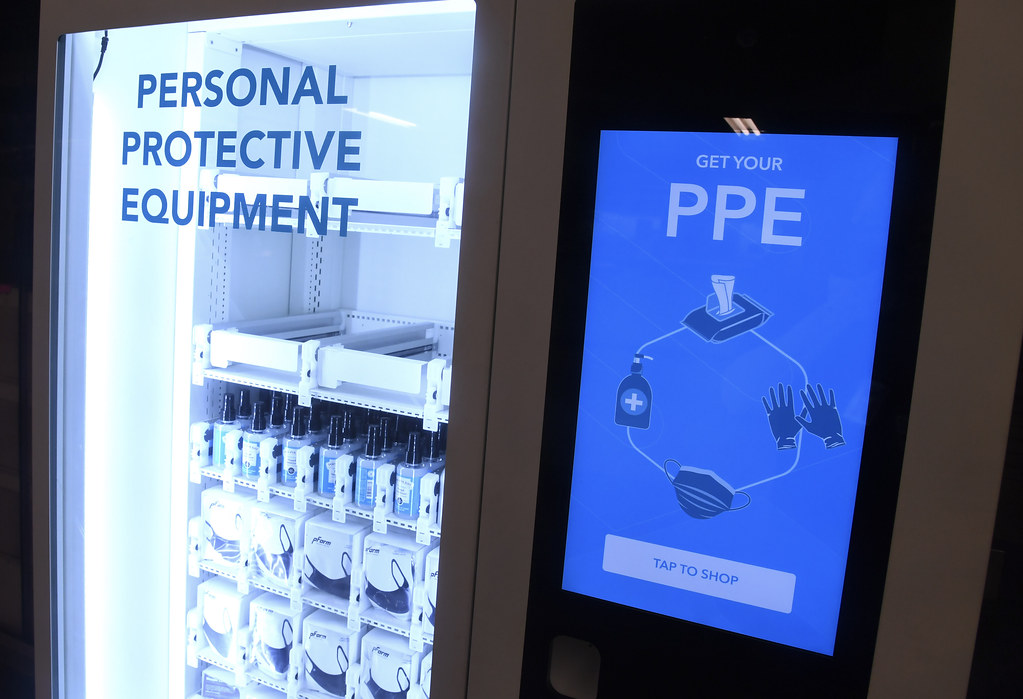

Featured image: by MTAPhotos is marked with CC BY 2.0.