A federal jury convicted a Florida man for his role in a $54 million bribery and kickback scheme involving TRICARE, a federal program that provides health insurance benefits to active duty and retired service members and their families.

According to court documents and evidence presented at trial, David Byron Copeland, 55, of Tallahassee, was a part-owner and senior sales manager at Florida Pharmacy Solutions (FPS), a Florida-based pharmacy that specialized in compounded prescription drugs. Copeland, along with his accomplices, engaged in a practice known as “test billing” to develop the most expensive combination of compounded drugs to maximize reimbursement from TRICARE. Copeland and his accomplices targeted physicians who treated TRICARE beneficiaries and paid bribes and kickbacks to physicians and salespeople to encourage the referral of prescriptions to FPS. The bribes included lavish hunting trips and expensive dinners. In addition, Copeland and his accomplices used “blanket letters of authorization” that allowed FPS to modify the prescription components to make them more profitable.

Copeland and his sales representatives were paid millions of dollars in kickbacks based on a percentage of the amount that TRICARE reimbursed for their prescriptions, which provided an incentive to seek prescriptions for the most expensive compounded drugs possible, including pain and scar creams. Copeland facilitated the kickbacks through companies he set up to receive and funnel the payments. From late 2012 through mid-2015, FPS billed TRICARE over $54 million for its compounded pharmaceuticals.

The jury convicted Copeland of two counts of soliciting and receiving illegal health care kickbacks and three counts of offering and paying illegal health care kickbacks. The jury acquitted Copeland of conspiracy to defraud the United States and to pay and receive illegal health care kickbacks. His sentencing is scheduled for Sept. 14. He faces a maximum penalty of 10 years in prison for each kickback count. A federal district court judge will determine any sentence after considering the U.S. Sentencing Guidelines and other statutory factors.

Two other men, James Wesley Moss, the former chief executive officer of FPS, and Michael Gordon, a former FPS sales representative, previously pleaded guilty for their roles in the scheme and are awaiting sentencing.

Assistant Attorney General Kenneth A. Polite, Jr. of the Justice Department’s Criminal Division; U.S. Attorney Roger Handberg for the Middle District of Florida; Special Agent in Charge Darrin K. Jones of the U.S. Department of Defense Office of Inspector General (DOD-OIG), Defense Criminal Investigative Service, Southeast Field Office; Special Agent in Charge Omar Perez of the U.S. Department of Health and Human Services Office of the Inspector General (HHS-OIG), Miami Regional Office; Special Agent in Charge David Spilker of the U.S. Department of Veterans Affairs Office of Inspector General (VA-OIG), Southeast Field Office; and Special Agent in Charge David Walker of the FBI Tampa Field Office made the announcement.

The DOD-OIG, HHS-OIG, VA-OIG, and FBI investigated the case.

Trial Attorneys Devon Helfmeyer, Katie Rookard, and Clayton Solomon of the Criminal Division’s Fraud Section are prosecuting the case.

The Fraud Section leads the Criminal Division’s efforts to combat health care fraud through the Health Care Fraud Strike Force Program. Since March 2007, this program, comprised of 15 strike forces operating in 25 federal districts, has charged more than 5,000 defendants who collectively have billed the Medicare program for more than $24 billion. In addition, the Centers for Medicare & Medicaid Services, working in conjunction with the Office of the Inspector General for the Department of Health and Human Services, are taking steps to hold providers accountable for their involvement in health care fraud schemes. More information can be found at www.justice.gov/criminal-fraud/health-care-fraud-unit.

Press release by DOJ.

Featured image: by ccPixs.com is marked with CC BY 2.0.

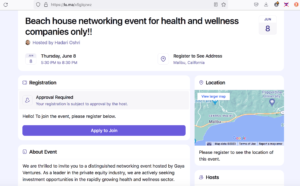

“We are thrilled to invite you to a distinguished networking event hosted by Gaya Ventures. As a leader in the private equity industry, we are actively seeking investment opportunities in the rapidly growing health and wellness sector,” says her

“We are thrilled to invite you to a distinguished networking event hosted by Gaya Ventures. As a leader in the private equity industry, we are actively seeking investment opportunities in the rapidly growing health and wellness sector,” says her