For now, Bitcoin is just another trading toy

Ah, Bitcoin. The stuff of dreams. The new frontier in currency and commerce. The gateway to a world dominated by blockchain technology, with newly-minted zillionaires lining of streets of urban and rural sites across the globe. Or, the speculative arm of a legitimate evolution of financial transactions.

Now, before you get all defensive about how amazing Bitcoin is, and tell me how out of touch I am (after all, at age 55, I am way too old to understand this stuff, right?), hear me out. I do see the role of blockchain technology in the global economy going forward.

However, I think of Bitcoin, the most famous of cryptocurrencies, like “Band-Aids” are to adhesive bandages (hint: same thing, but one is a brand name, the other is just what the product is). Bitcoin is the proverbial poster-child for this new way to hold money. That is all fine with me. My point, though: just don’t pretend it is a substitute for traditional hard currencies. Not yet, anyway.

Bitcoin: what it is and what it isn’t

My evidence for that statement: the price of Bitcoin is not at all stable. Its price is more volatile than most stocks. You wouldn’t take the money you need to pay this month’s mortgage or buy food for your family’s dinners this week, and put it in an S&P 500 Index Fund, would you? Actually, I am afraid of the answer from too many investors. But I digress. The point is that Bitcoin still appears to be a trading tool (toy?), rather than a “store of value,” which is the textbook definition of a stable asset.

For that reason, I refuse to look at Bitcoin as a currency when following its price movement. However, as a vehicle to trade to make profit on over periods of time, I see it the way I see stocks and ETFs: as something to chart, and to evaluate its reward/risk trade-off at any point in time.

And, while I have not yet invested Bitcoin for my clients or myself, I am willing to consider it if it meets my usual investment criteria. One of those is that it can be charted.

What do the charts say about Bitcoin now?

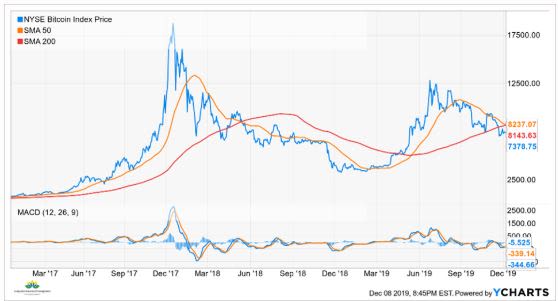

Remember that time when Bitcoin ran up to seemingly impossible heights, then dipped below 8,000, then crashed to under 4,000? Above, you see the price of Bitcoin over the past couple of years. It shows that last dizzying episode from 2018. And to me, it appears to be setting up for a repeat downward performance in 2020.

Now, technical analysis (charting) is more precise when there is deeper data and history behind the price activity. With Bitcoin’s limited history as a popular asset, and the fact that it is not a business like a stock, we have less to work with than we would with a stock or commodity. However, if you look at the right side of the chart, you see an orange line—the 50-day moving average of Bitcoin’s price. That line is falling, and it is close to falling below the red line—the 200-day moving average. This is occurring while Bitcoin is quietly in the midst of repeating its early 2018 price pattern.

That last round of Bitcoin price drama had a similar pattern, as you can see in May of 2018. At that point, the orange line crossed below the red line, just as it is poised to do now. That “death cross,” as chart geeks often call it, is happening now at about the same Bitcoin price level (8,200) as it did then.

Will history repeat?

I don’t know, but I wouldn’t simply blow this off as a coincidence. After all, the downside risk of ignoring the chart pattern in Bitcoin was about $5,000. Bitcoin fell from that 8,200 level to about 3,250 at its December, 2018 low, before quadrupling in value 7 months later.

And that brings me back to my main point: Bitcoin is not an “investment” at this stage of its development as a marketable security. Neither are small marijuana companies and penny stocks. They are trading tools for virtual rooms of speculators. It is somewhere between a casino and the latest version of the “greater fool theory,” where you can profit from owning it as long as someone is willing to buy it from you. I would insert an analogy to tulip bulbs here, but suffice it to say, just look that up yourself.

“Big shots”

Last point: one of my personal investment tenets, and what I say to clients who tell me they are investing in Bitcoin or some other trading toy, is this: “It’s OK to take big shots, as long as you do it with small amounts of money.” Just don’t confuse speculation with investing.

Rob Isbitts is founder of Sungarden Investment Research.