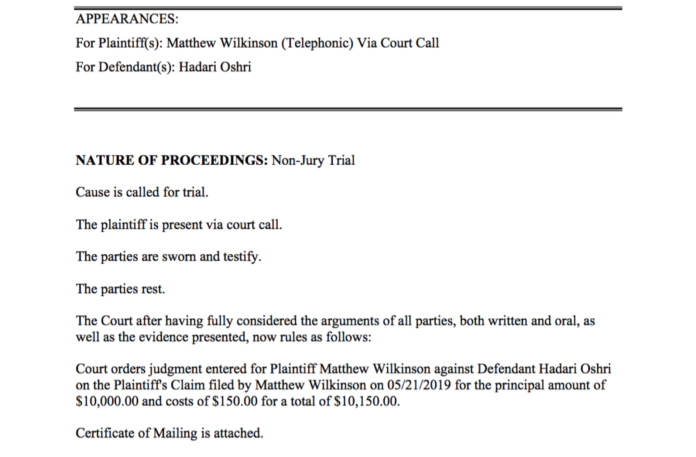

2019 court case against Hadari Oshri exposes her dodgy, aggressive legal maneuvers

AN IMPORTANT NOTE: On June 22, 2021, Hadari Oshri –Marc Lubaszka’s business partner– filed a frivolous civil harassment restraining order (CHRO) against Investor News...

$90 Million Yacht of Sanctioned Russian Oligarch Viktor Vekselberg Seized by Spain at Request of US

Note: Footage of the seizure is available here. View the statement from the Attorney General on today's seizure here.

Spanish law enforcement this week executed a Spanish court...

Takeover Bid of Fortune 500 Company was a Sham, SEC claims

The Securities and Exchange Commission has charged Melville ten Cate, a U.S. citizen residing abroad, with fraud stemming from his allegedly phony offer to...

SEC Proposes Rules to Include Certain Significant Market Participants as “Dealers” or “Government Securities Dealers”

Washington D.C. — The Securities and Exchange Commission has proposed proposed two rules that would require market participants, such as proprietary (or principal) trading...

SEC Proposes Rules to Enhance Disclosure and Investor Protection Relating to Special Purpose Acquisition Companies, Shell Companies, and Projections

Washington D.C. — The Securities and Exchange Commission today proposed new rules and amendments to enhance disclosure and investor protection in initial public offerings...

Tech Company Employees, Family and Friends Charged in $1M Scheme in California

SEC Charges Seven California Residents in Insider Trading Ring

Washington D.C. — The Securities and Exchange Commission has announced insider trading charges against three software...

Women’s History Month Event: SEC to Host Free Virtual Financial Fraud Webinar

Washington D.C. — On March 29, 2022 at 7 p.m. ET the Securities and Exchange Commission’s New York Regional Office, in coordination with Alpha...

SEC Proposes Amendments to Remove References to Credit Ratings from Regulation M

Washington D.C. — The Securities and Exchange Commission has voted to propose changes that would remove the references to credit rating agencies from existing...

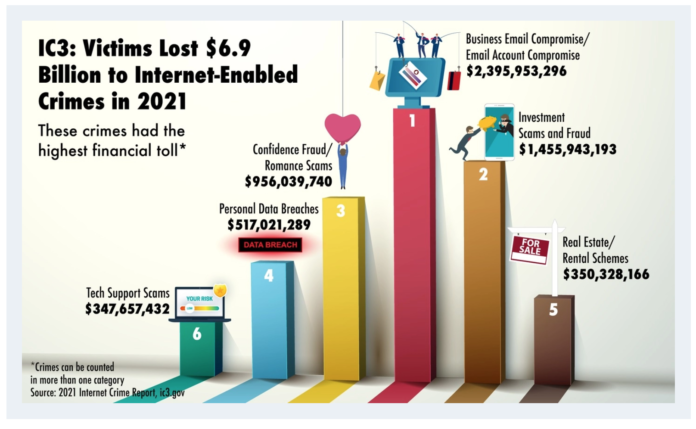

FBI crime report released: Victims lost $6.9b to internet-enabled scams in 2021

The FBI’s Internet Crime Complaint Center (IC3) has released its annual report.

The 2021 Internet Crime Report (pdf) includes information from 847,376 complaints of suspected internet crime—a 7%...

SEC Proposes Rules to Enhance and Standardize Climate-Related Disclosures for Investors

Washington D.C., March 21, 2022 —

The Securities and Exchange Commission today proposed rule changes that would require registrants to include certain climate-related disclosures in...