Bitcoin Attempts Price Recovery After a Derivatives-Led Slide to Sub-$56K

Fears about a supply glut from the Mt. Gox settlement are unfounded, one analyst said.

Bitcoin is looking to regain its footing, having reached five-week lows early Friday in a move market participants said was driven by derivatives.

The top cryptocurrency had recovered to $57,200 at press time from the low of $55,666 reached during the early European trading hours. That was the lowest level since Oct. 13.

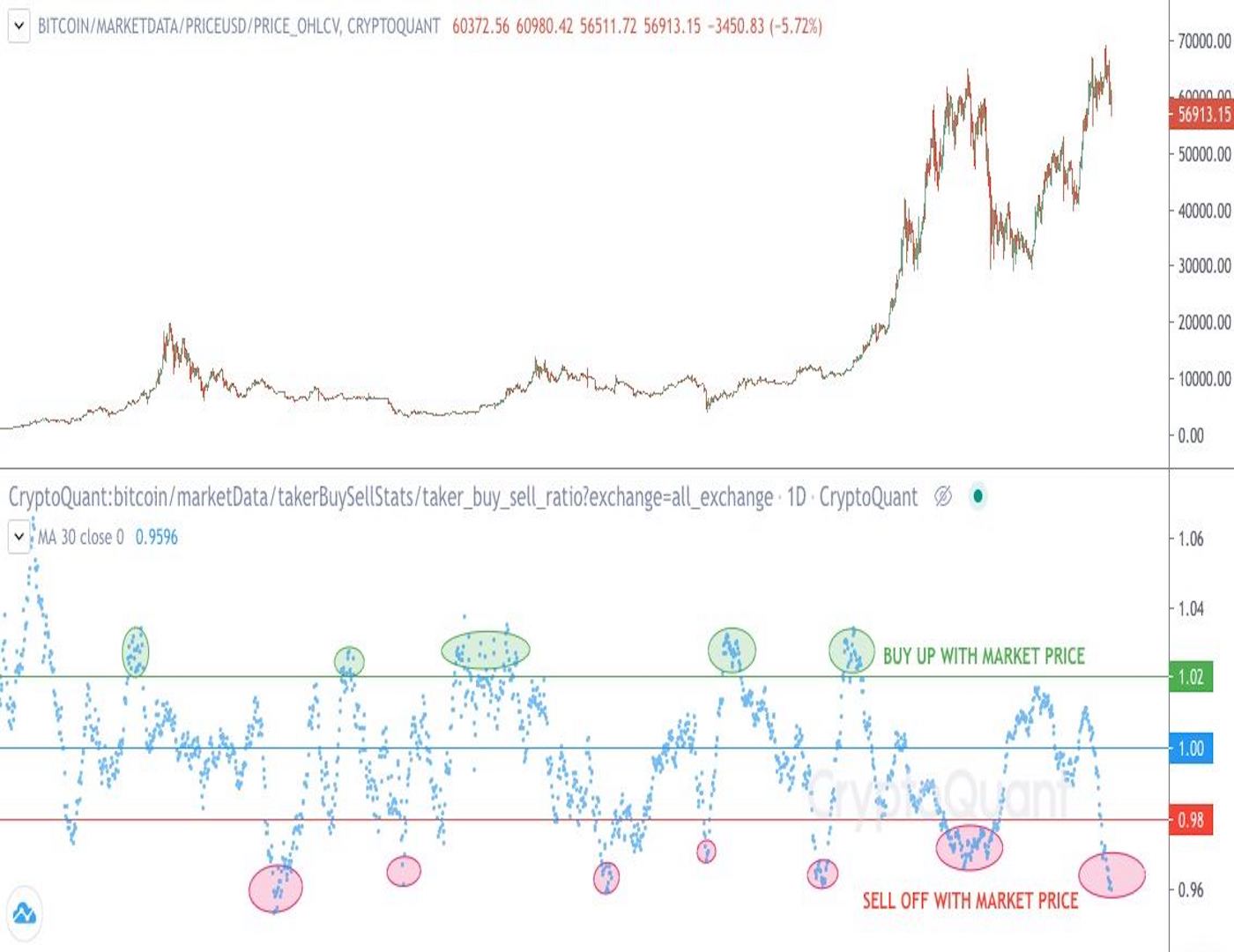

The early drop was predominantly driven by traders taking short positions in the perpetual futures market, according to Ki Young Ju, CEO of blockchain analytics platform CryptoQuant. “The market sentiment was sell, according to the taker buy-sell ratio,” Ju said. “More people were shorting bitcoin via market orders.”

The taker buy-sell ratio is the ratio of buy volume divided by the sell volume of takers in perpetual swap trades in all derivative exchanges. Individual investors, small firms are referred to as price takers. Former Secretary of State Hillary Clinton calling cryptocurrencies a destabilizing force at a Bloomberg event may have triggered selling.

Daniel Kukan, senior cryptocurrency trader at Swiss-based Crypto Finance AG, said, “We did not see big sellers at all; the move was derivatives driven.”

Noelle Acheson, head of market insights at Genesis Global Trading, attributed the recent slide from record highs near $69,000 to fears that the finalization of settlement claims against defunct crypto exchange Mt. Gox and resolution of the ongoing court battle between Ira Kleiman and Craig Wright for rights to Satoshi Nakamoto’s 1.1 million BTC wallet may bring selling pressure to the market.

Acheson, however, said that these fears are unfounded. “The timing [of the Mt. Gox settlement] is still unclear and could be in 2022 or even 2023. Also, many of the claim holders are hedge funds that may or may not choose to sell,” Acheson said.

Regarding the court battle, Acheson said a win for plaintiff Kleiman is unlikely to lead to the release of a significant portion of the locked coins as feared by some traders. That’s because the defendant has failed to produce evidence of having access to the BTC in question, even should he lose.

Data tracked by Glassnode shows no signs of panic selling by long-term investors. Supply owned by long-term holders has declined by just 26,461 bitcoin since Nov. 10., representing a meager 0.19% of their balance, according to Glassnode data. Bitcoin’s liquid supply has decreased by 145,000 BTC over the past 30 days.

Meanwhile, data shared by IntoTheBlock shows more than 20,000 coins have left centralized exchanges in the past seven days.

“Fears of selling pressure appear to be more of a justification than a reason for the market correction, which has the characteristics of a normal breather to a bull run and a healthy reduction of leverage,” Acheson noted.